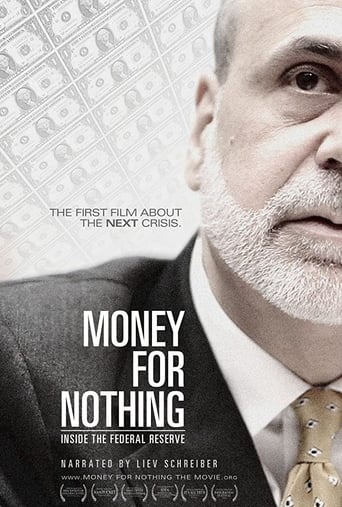

Money for Nothing: Inside the Federal Reserve (2013)

Nearly 100 years after its creation, the power of the U.S. Federal Reserve has never been greater. Markets and governments around the world hold their breath in anticipation of the Fed Chairman's every word. Yet the average person knows very little about the most powerful - and least understood - financial institution on earth. Narrated by Liev Schreiber, Money For Nothing is the first film to take viewers inside the Fed and reveal the impact of Fed policies - past, present, and future - on our lives. Join current and former Fed officials as they debate the critics, and each other, about the decisions that helped lead the global financial system to the brink of collapse in 2008. And why we might be headed there again.

Watch Trailer

Cast

Similar titles

Reviews

Pretty Good

Perfect cast and a good story

Best movie ever!

The plot isn't so bad, but the pace of storytelling is too slow which makes people bored. Certain moments are so obvious and unnecessary for the main plot. I would've fast-forwarded those moments if it was an online streaming. The ending looks like implying a sequel, not sure if this movie will get one

I'll save you the time: the "Great Moderation" that I began working during in 1984 is over. The stock market bubble became the housing bubble which became ... the Government Debt bubble (which has yet to burst). It's incredible to watch each crisis, and how each one has driven interest rates lower and lower, until we are at ... zero. We have created a scenario where we can't lower them again. Quantitative easing has kept us afloat but for how long?Inflation remains low but my understanding is the CPI no longer includes food or energy? And while unemployment has lowered my understanding is that is because people have left the workforce, and very few if any "real jobs" have been created. The films producers point out we are an economy that has consumed more than we have produced for an entire decade. They ask the question: "how long can this continue?"The film really got me thinking about a term they brought up: "moral hazard." If I know the Fed will bail me out on the downside why not accept the risk? It also applies in my mind to debt. In olden days people worried about putting debt on their children and grandchildren. That's no longer the case for many people like me. Free Heath care? Why not? Oh if an anti-viral will save me I can practice unsafe sex? Why not? I never knew it had a name but it does: "moral hazard" and I think it's becoming rapidly absent in modern society.It's especially applicable to the Justice System. I'm now officially a true crime addict. And one common thread in these horrendous cases is truly dangerous people are released into society time and time again. Criminals routinely violate their paroles with no negative consequences. Yes I'm against the "Prison State." But if we promise to punish but in the end "bail out" the truly bad guys, what are the consequences for a safe society? No easy answers.Anyway I suppose I should start a blog rather than meander in emails. This movie is kinda a snoozer but I wanted to share my thoughts.

One of the best documentaries I've seen demonstrating how the role of the Federal Reserve contributed to the Financial Crisis of 2008. In the wake of the financial collapse of 2008 creating a Recession which could have led to another Great Depression, a lot of blame was leveled against Investment Banks who were vilified as being greedy, particularly Lehman Brothers and Bear-Stearns, and insurance companies like AIG who undertook too many credit default swaps. The financial banks had taken on nearly as much debt as their assets, particularly in sub-prime mortgages, and AIG had insured them against default, i.e. "default swaps". When Lehman went bankrupt, AIG owed trillions of dollars in insurance against default, which nearly brought down the financial system.Now, while Lehman and Bear-Stearns share plenty of the blame in the recent crisis, these bad debts and faulty reliance on sub-prime mortgages were not solely private sector malfeasance. A US department agency also played a crucial role: The US Federal Reserve. The US Federal Reserve ("The Fed") since Alan Greenspan became Fed Chairman in the late 1980's under then President Ronald Reagan engaged a more "hands-off" policy in terms of financial regulation and at the same time allowed much more loan money to be acquired by these private financial institutions who in turn bought into risky investments. This documentary outlines why the Fed was created in the first place, its role over the years in terms of both regulating and stimulating financial markets and what it did and didn't do to contribute to the recent financial collapse. While I don't believe the Fed was solely responsible for the financial collapse, as suggested by the film, their policy approaches were vital as one of many contributing factors which created a financial "perfect storm".Two of the leading characters whose roles were crucial in the Fed's policy-making in this unfolding drama were the two Fed Chairmen Alan Greenspan (1987-2006) and Ben Bernanke (2006-2014). Greenspan in particular was touted as a financial guru who understood financial markets better than a Super Bowl winning football coach understands how to get first downs and touchdowns. If Greenspan didn't know the answer to an aspect of the financial market, the question itself must be flawed, or so went the conventional wisdom for nearly 30 years. To his credit, Greenspan had steered the US economy through several storms. What he didn't know was that a financial hurricane was descending upon Wall Street.Over and over, Greenspan had opportunities to regulate aspects of the financial markets, particularly the so-called credit default swap insurance policies, issued by the likes of AIG and others. He also could have reigned in loose lending practices. Once, early on as Fed Chairman, Greenspan hinted the stock market may be spiraling out of control, but was quickly vilified by Wall Street for his remarks. Since then, during much of his tenure, he took a position of deregulation in which "the market will figure it out" approach so prevalent in Conservative politics. Ben Bernanke, who is a self-described scholar of the Great Depression, also didn't see the financial collapse coming. In several interviews prior to the beginning of the collapse, Bernanke iterates the impossibility of a national drop in housing prices. His scholarship for some reason precluded him from seeing the coming crisis, first in terms of the bursting housing bubble, then the ensuing financial crisis which was spawned as a result.While scholars have debated and will continue to do so over the next century over the reasons for the financial crisis, several things are clear about the Recession. The Fed contributed to the collapse with certain policies, greed does not necessarily regulate itself, and no single individual can know everything about every aspect of the market. At the ensuing congressional hearings which Congress called after the collapse, Greenspan admitted the flaws of his policies. He said he assumed that financial institutions would always make the best decisions which would be in the interest of their companies. The reality is, just like everything else in a complex modern world, the private sector cannot always be counted on to make the best of decisions, be it for their companies or the worldwide economy. The Fed has a role to play in at least helping to thwart a possible crisis in the future. That role is always endlessly debated by politicians, congressmen, financiers, advisers and occasionally scholars. Let's hope the financiers won't always get 100% of their desires.

A gem in the movie industry, conveying the federal reserve as pacifist who hates the idea of forcing people to come to grips with reality. Conveying the federal reserve as having foresight all the time,even though there is some denial of this near the end. The very pacifist mentality was the ideal of the federal reserve to act as a cushion to protect the delusions of the public rather than act as moralist dictator. So the federal reserve allowed investment out self interest that had no direct long term benefit to society this was more acceptable than forcing a moralist view on the economy. One of the prime reasons the fed always acted as a cushion rather than a moralist was the monetary gain, which were only asset inflation and this was the delusion of the people. Against there better judgement they obeyed the people's will in general. The asset inflation is inflation mistaken as monetary gain, however when ever individuals profit by inflation inequity rules as they got the money for free or nearly free. For the investors get rich, those who own stock and houses and so on, and everyone else suffers poverty. No one wishes to change this as that would create the appearance of monetary redistribution. Worse yet because the market gains where an illusion, there are no new jobs for the youth as there shall always be to many people and not enough jobs, as industry is very efficient in the new computer robotic global economy.Hence everyone must work less hours so everyone can work otherwise pay for a welfare state which has negative effects in itself, for if neither of these are done The People shall and will starve to death as there is lots of food and shelter, but no self dependence everyone is dependent upon jobs to get those things, as in past the majority had their own land to farm upon and now they do not. To any length the problem can never be solved by the monetary federal reserve. It was never their fault in the first place. Blaming a bunch of pacifist who would do anything to ensure the economy kept going given the conditions of a computer robotic global economy is a sad lie. These federal reserve people call it the free market but what they are meaning is forcefulness is rape, they simply hate pushing their morals upon a people who do not want them, people wanted free money and so they got what they desired. The sacrifices we must make to remain a compassionate society is something that is going to be token by force. Plainly none of us are honest enough to admit we have stolen from ourselves a fair and equitable society. Where money is earned by giving to society a long lasting benefit in service, rather than just profiting our selves, I can say being a pacifist myself, I have lost everything by a forceful economy that was self serving and now I have profited being self serving. If someone takes by force what I have token without any benefit to society, at least I can say its fair enough to me.

A must-see film for investors looking to understand the recent Boom & Bust cycles produced by the Federal Reserve. More importantly, a must-see film for investors looking to dodge the next BIG bubble. The producer does an excellent job illustrating the history of the Federal Reserve and its original role in the economy. Most impressive, is the quality of the cast interviewed during the film. Members of the Federal Reserve, IMF, Bank of International Settlements, and famous economists to name only a few examples. The credibility of these individuals gives the information more weight than the average documentary. Finally, the film goes on to explain how the Federal Reserve has become something that was not originally intended during its creation, a political instrument that impacts every one of us. Never has it been more important to understand this concept and how it applies to the next big bubble being created as we speak.